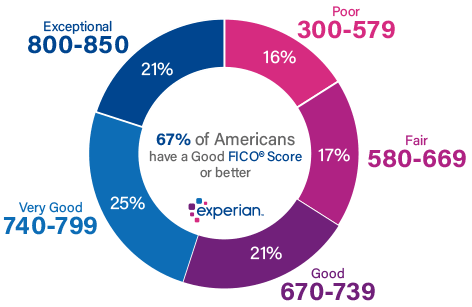

A credit score is a three-digit figure computed from information on a credit report that varies from 300 to 850. A credit score of 670 to 739 on the FICO® Score range is considered good, while a credit score of 661 to 780 on the Free Credit Score range is considered good.

Image from the post What Is a Good Credit Score?

A credit score, which runs from 300 to 850, is a numerical rating that assesses a person’s ability to repay a debt. A better credit score indicates that a borrower is less risky and more likely to pay on time. Credit ratings are frequently used to predict whether or not a person will pay back debts such as loans, mortgages, credit cards, rent, and utilities. Credit scores can be used by lenders to determine loan qualification, credit limit, and interest rate.

A credit score of 700 or above is regarded good for a score ranging from 300 to 850. A score of 800 or higher on the same scale is considered outstanding. The majority of people have credit scores ranging from 600 to 750.

In 2020, the average FICO® Score in the United States was 710, up seven points from the previous year. Higher grades can reassure creditors that you will return your future loans on time. However, creditors may define what they regard to be good or negative credit ratings when evaluating clients for loans and credit cards.

This is partly determined by the types of borrowers they wish to attract. Creditors may also consider how recent events may affect consumers’ credit scores and change their criteria accordingly. Although some lenders construct their own unique credit scoring programmes, the two most widely utilised credit scoring models are those produced by FICO® and VantageScore®.

What Is an Appropriate FICO® Score?

FICO® generates various sorts of consumer credit scores. The company creates “basic” FICO® Scores for use by lenders across many industries, as well as industry-specific credit scores for credit card issuers and auto lenders. FICO® Scores vary from 300 to 850, with 670 to 739 being considered “excellent.” FICOindustry-specific ®’s credit scores range from 250 to 900. The middle categories, on the other hand, have the same groupings, and a “excellent” industry-specific FICO® Score is still 670 to 739.

What Is an Appropriate VantageScore?

VantageScore’s initial two credit scoring models have 501 to 990 ranges. The two most recent VantageScore credit scores (VantageScore 3.0 and 4.0) use the same 300–850 range as the base FICO® Scores. VantageScore defines a good range for the current models as 661 to 780.

What Factors Influence Your Credit Scores?

Making on-time payments on your credit accounts might improve your credit score. Missing payments, having an account sent to collections, or declaring bankruptcy can all lower your credit score. Credit usage includes how many of your accounts have balances, how much you owe, and how much of your credit limit you’re using on revolving accounts.

Credit history length:

The average age of all your credit accounts, as well as the ages of your oldest and newest accounts, are included in this category.

Account types include:

This, often known as “credit mix,” analyses whether you manage instalment accounts (such as a vehicle loan, personal loan, or mortgage) as well as revolving accounts (such as credit cards and other types of credit lines).

Demonstrating that you can safely manage both types of accounts often improves your ratings.

Recent activity:

This factor takes into account if you have lately applied for or opened new accounts. FICO® and VantageScore approach the relative value of the categories in different ways.

FICO® Score Elements

FICO® utilises percentages to show how important each category is in general, but the specific percentage breakdown used to generate your credit score will be determined by your individual credit report. FICO® considers the following rating variables in the following order:

- 35 percent payment history

- Total amount owed: 30%

- 15 percent credit history length

- 10 percent credit mix

- 10% for new credit

VantageScore Elements

VantageScore ranks the criteria in terms of how relevant they are in determining a credit score, although this will also rely on your individual credit report. Free Credit Score examines the following factors in the following order:

- Total credit usage, balance, and available credit: All have a significant impact.

- Credit mix and experience: Significant

- Payment history: Moderately powerful

- Credit history age: less influential

- New accounts opened: Less influential

What Credit Scores Do Not Take Into Account

When generating credit ratings, FICO® and VantageScore do not take the following factors into account:

Your ethnicity, race, religion, national origin, gender, or marital status. (Under US law, credit scoring systems are not permitted to take into account these facts, as well as any receipt of public assistance or exercise of any consumer right under the Consumer Credit Protection Act.) It’s your age. Salary, occupation, title, employer, date of employment, or work history (However, keep in mind that lenders may take this information into account when making overall approval choices.)

Where you reside.

Inquiries should be gentle. Others frequently launch soft inquiries, such as organisations making promotional credit offers or your lender doing periodic assessments of your current credit accounts. Soft inquiries are also generated when you examine your own credit report or use credit monitoring services from organisations such as Experian. These queries have no effect on your credit scores.

Why Are Credit Scores Different?

Credit scores are used by lenders to determine loan decisions. FICO® and VantageScore develop separate credit scoring models for lenders, and both firms release new versions of their credit scoring models on a regular basis, much like other software companies release new operating systems. The most recent versions may include technical advancements or changes in consumer behaviour, or they may better conform with new regulatory requirements.

VantageScore, for example, develops a tri-bureau scoring model, which means that the same algorithm can evaluate your credit report from any of the three major consumer credit agencies (Experian, TransUnion and Equifax). In 2006, the first version (Free Credit Score 1.0) was created. Free Credit Score 4.0, the most recent version, was launched in 2017 and was built using data from 2014 to 2016. It was the first generic credit score to include trended data, or how people manage their accounts over time.

FICO® is a more established corporation that was among the first to develop credit scoring models based on consumer credit records. It develops multiple versions of its scoring models for use with the data from each credit bureau, albeit latest versions share a common moniker, such as FICO® Score 8. Consumer FICO® Scores are classified into two types:

Base FICO® Scores: These scores are designed for use by any type of lender and try to estimate the likelihood of a consumer falling behind on any form of credit commitment. FICO® base scores range from 300 to 850. FICO® Scores for Specific Industries: FICO® develops auto ratings and bankcard scores exclusively for auto lenders and card issuers.Industry ratings range from 250 to 900 and strive to forecast the likelihood that a consumer will go behind on a specific type of account.

FICO® industry-specific scores are constructed on top of a foundation FICO® Score, and FICO® publishes new suites of scores on a regular basis. For example, the FICO® Score 10 Suite was launched in early 2020. It comprises a FICO® Score 10 baseline, a FICO® Score 10 T (with trended data), and new industry-specific scores.

Scores are also used infrequently. For example, FICO® is gradually introducing the UltraFICO® Score, which allows consumers to link checking, savings, or money market accounts and takes banking behaviour into account. Lenders may also develop specialised credit scoring models for their intended consumers. Lenders can select the model they want to utilise. In fact, some lenders may elect to continue with outdated versions due to the expenditure that switching may entail. In addition, many mortgage lenders employ older versions of the underlying FICO® Scores to comply with government-backed mortgage companies Fannie Mae and Freddie Mac rules.

In addition, you may not know whose credit report and score a lender will use until you submit an application.

The good news is that all consumer FICO® and VantageScore credit scores use the same underlying information to compute your credit scores—data from one of your credit reports. They are also all attempting to estimate the possibility that a person will become 90 days past due on a bill (either in general or on a specific sort) within the next 24 months.

As a result, the same factors can have an effect on all of your credit scores. If you watch various credit scores, you may see that your scores differ depending on the scoring model and which of your credit reports it examines.

However, you may see that they all tend to rise and fall together over time.

Why Is a Good Credit Score Important?

In general, having good credit might make it easier to achieve your financial and personal goals. It could mean the difference between getting approved or denied for a major loan, such as a home mortgage or auto loan. And it can have a direct impact on how much interest or fees you’ll have to pay if you’re approved.

The difference between a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score, for example, may be $72 per month. That’s money you could be spending toward savings or other financial objectives. A good credit score might save you $26,071 in interest payments over the life of the loan.Credit ratings can also influence non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your Free Credit Score reports (but not your consumer credit scores) can have other consequences for you. Some employers may check your credit records before employing or promoting you. In addition, in most states, insurance firms may utilise Free Credit Score ratings to assist calculate your auto, home, and life insurance premiums.

How to Raise Your Credit Score

Focus on the fundamental variables that affect your Free Credit Score to enhance them.The fundamental actions you must follow are quite straightforward:

- Make at least your minimum payment, and pay off any debts on schedule.

- A single late payment can have a negative impact on your credit score and can stay on your credit report for up to seven years.

- If you suspect you will miss a payment, contact your creditors as soon as possible to see if they can work with you or provide hardship solutions.

- Maintain a low credit card balance.

- Your credit utilisation rate, which compares the current amount and credit limit of revolving accounts such as credit cards, is an important scoring element.

- A low credit use rate can improve your credit scores.

- Individuals with great credit typically have an overall utilisation rate in the single digits.

- Accounts that will be reported to credit bureaus should be opened.

- If you have few credit accounts, make sure that any new ones you open are posted to your credit report.

- These could be instalment accounts like student loans, vehicle loans, home loans, or personal loans, or revolving accounts like credit cards and lines of credit.

- Only apply for credit when you absolutely need it.

- Applying for a new account may result in a hard inquiry, which can lower your credit score slightly.

- The impact is normally modest, but applying for multiple types of loans or credit cards in a short period of time may result in a higher score decline. Other factors can also have an impact on your scores. Increasing the average age of your accounts, for example, could improve your results. However, it is frequently a case of waiting rather than acting.

- Checking your credit ratings may also provide you with information on how to improve them. For example, when you check your free Experian FICO® Score 8, you can also see how you’re performing in each of the credit score areas.

You’ll also get a quick snapshot of your score profile, including what’s helping and hindering your score.

What Should You Do If You Do Not Have a Credit Score?

Credit scoring models use your credit reports to calculate your score, however they cannot evaluate reports with insufficient information. FICO® Scores require the following:

- A minimum of six-month-old account

- An account that has been in use for the last six months

- VantageScore can evaluate your credit report if it has at least one current account, even if it is less than a month old.

- If you are not creditworthy, you may need to create a new account or add fresh activity to your credit report in order to begin developing credit.

- This frequently entails beginning with a credit-builder loan or secured credit card, or becoming an authorised user.

What Caused Your Credit Score to Change?

Your credit score might alter for a variety of reasons, and it’s not uncommon for scores to fluctuate during the month when new information is uploaded to your credit reports. You might be able to pinpoint a single occurrence that results in a score change. A late payment, for example, or a new collection account will almost certainly damage your credit score.Paying off a large credit card amount and lowering your utilisation rate, on the other hand, may raise your credit score.

However, some activities may have an unexpected impact on your credit scores. Paying off a loan, for example, may result in a decline in your scores, despite the fact that it is a beneficial activity in terms of appropriate financial management. This could be because it was the only open instalment account or loan with a low balance on your credit report. After repaying the loan, you may be left with only high-balance loans or no open instalment or revolving accounts.

After paying off your credit card debt, you may elect to discontinue using them. Avoiding debt is a good strategy, but inactivity in your accounts may result in a lower score. To keep your account active and develop an on-time payment history, you may choose to use a card for a small monthly subscription and then pay off the debt in full each month.

Remember that credit scoring methods rely on complex computations to obtain a score. You may believe that one occurrence caused your credit score to rise or fall, but this is only a coincidence (for example, you paid off a loan, but your score actually increased due to a lower credit utilisation ratio).Furthermore, a single incident isn’t “worth” a set number of points; the point change is determined by your full credit record.